What’s in store for me this year as a 1+1 Plan participant?

14 April 2022

We launched the 1+1 Sharing in Our Future Plan to allow all our colleagues – the driving force behind our business – to share in our collective future. Read our full year results? Then you’ll have seen the progress your contribution made. As a result, Kingfisher proposed a shareholder dividend of 8.60 pence per share payable on 27 June 2022, subject to shareholder approval at the upcoming Annual General Meeting (AGM).

But there’s always more we can achieve together. That’s why we’ve also announced a further opportunity to join our 1+1 Plan. A fresh chance for all our 82,000 colleagues to join us as shareholders, once again sharing in our future.

Read on to find out more.

Current share price volatility

Currently the Kingfisher share price is lower than in recent months. So too is the value of the FTSE 100 index as a whole. In our first edition of 1+1 News we told you about some of the different things that can affect share prices. Share prices rise and fall many times a day. Typically, these share price movements are small or follow a trend, but there can also be larger fluctuations. These are often caused by impactful and/or unexpected events.

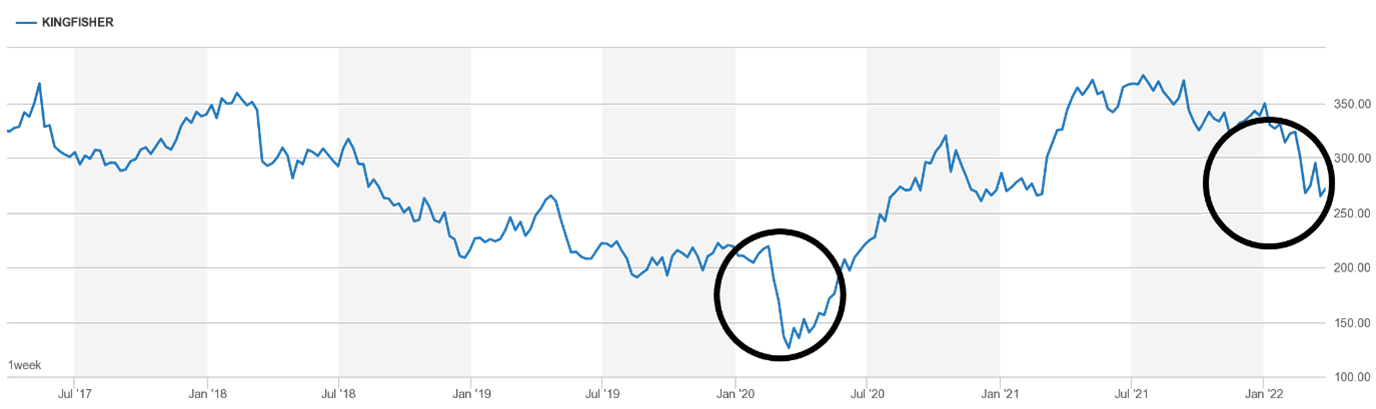

The chart below shows the Kingfisher plc share price over the last five years and highlights the circled larger share price drops which link to two specific events. The first was the COVID-19 pandemic, and the second, when the tragic events in Ukraine started to unfold.

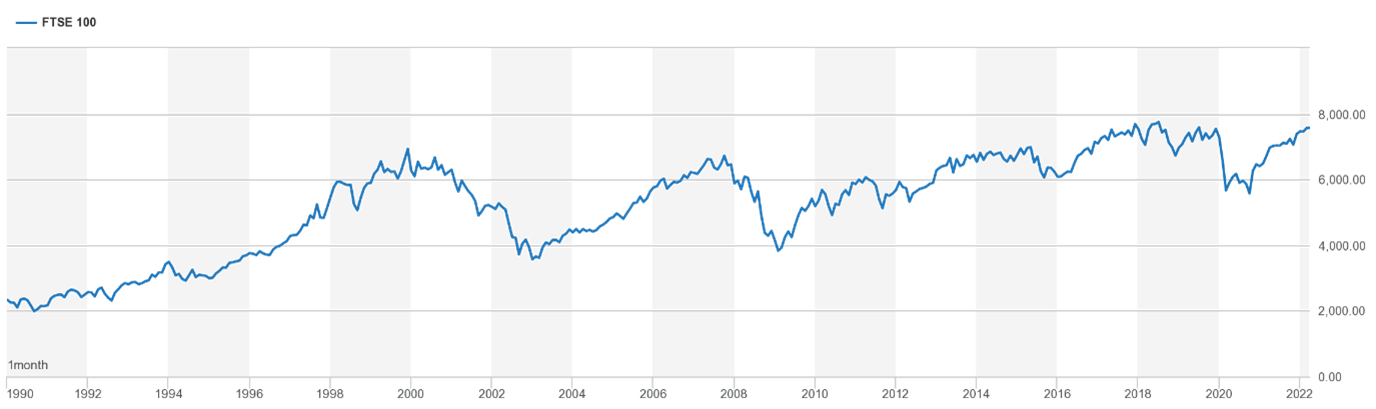

The chart below shows the value of the FTSE 100 index since 1990. You can see the same two drops in value of the FTSE 100 index that you can see in the Kingfisher share price data. You’ll also see a drop in 2000 coinciding with the burst of the dot-com bubble, the 11 September 2001 terrorist attacks in the United States of America, and then speculation of war in Iraq in 2002. There was also a drop at the end of 2007 due to the banking crisis. Despite these events, there has been a steady increase in the value of the FTSE 100 index over time.

Companies seek to mitigate the impact of unexpected events by focussing their energies on things that are within their control. Take COVID-19 as an example: teams across Kingfisher, particularly those in store roles, approached the challenges it brought with determination, sensitivity, and commitment. As well as this, companies can also put in place strategies that help steer and direct through challenging times. Think about the ‘Powered by Kingfisher’ strategic plan – it is focused on creating growth and shareholder value. Read our full year results and you can find out how.

What’s in store for me this year as a 1+1 Plan participant?

Five things to watch over the coming months:

- Use your shares to vote in Kingfisher’s Annual General Meeting (AGM) – it’s optional, but it is a great way to get your voice heard. Details to follow in the coming months.

- Automatically receive a dividend payment of 8.60 pence per share on 27 June 2022 (subject to shareholder approval at the AGM) which under the 1+1 Plan will be reinvested into additional shares. We’ll let you know more about this nearer the time.

- Your Matching Shares and Matching Dividend Shares unlock in July. Alongside your Purchased Shares and Purchased Dividend Shares, they will fully belong to you to hold, sell, or transfer after paying any taxes that may be due. We’ll tell you everything you need to know in advance.

- Keep an eye on the Kingfisher share price: watching the rise and fall can be interesting. The 1+1 Plan has a 1:1 match which reduces the impact of share price volatility because you have more shares than you’ve bought.

- Want to do it all over again? Keep an eye out for details of the 1+1 Plan relaunch later this year.

How can I find out more?

You can find out more about the 1+1 Plan at kingfisher-shareplan.com. To ensure you’re up-to-date on Kingfisher’s full year results you can read the full year results on kingfisher.com. Last but not least, check out the Kingfisher share price at the Investor section on kingfisher.com and view the value of your fund on EquatePlus.