Introduction to Shares and Share Prices

3 June 2021

For some of you, the 1+1 Plan will be your first experience of becoming a shareholder. So, in this edition of 1+1 News, we’ll tell you about what it means to be a shareholder, with a focus on share prices. We hope that you’ll find this edition interesting no matter your current level of knowledge and experience.

What does becoming a shareholder mean for me?

Anyone who owns at least one share in a business or company is a shareholder. As a participant of the 1+1 Plan you’ll become a Kingfisher shareholder in July 2021 when your Purchased Shares are bought. Becoming a shareholder will entitle you to vote at the Annual General Meeting (AGM) in 2022 and you will receive dividend payments if the company chooses to pay them. Dividends are small payments of company profits that under the 1+1 Plan will be re-invested into shares. Each of your shares has a value known as a share price. Share prices may rise or fall, so it is important to understand the kind of things that influence their value as this affects what your shares are worth.

What are shares and what can affect their value?

The value of a company is divided into individual parts called shares. Each share represents ownership of that company in relation to the proportion of shares held. Kingfisher plc is a Public Limited Company (PLC), which means that like other PLCs, its shares are traded on the London Stock Exchange. The value of these shares is determined by the demand for them and the amount that are available on the market. Increases and decreases in share price can be large or small in value and happen many times throughout the day as others buy and sell their shares. If demand for a company’s shares is high, their price will typically increase and if demand reduces, their price will typically decrease.

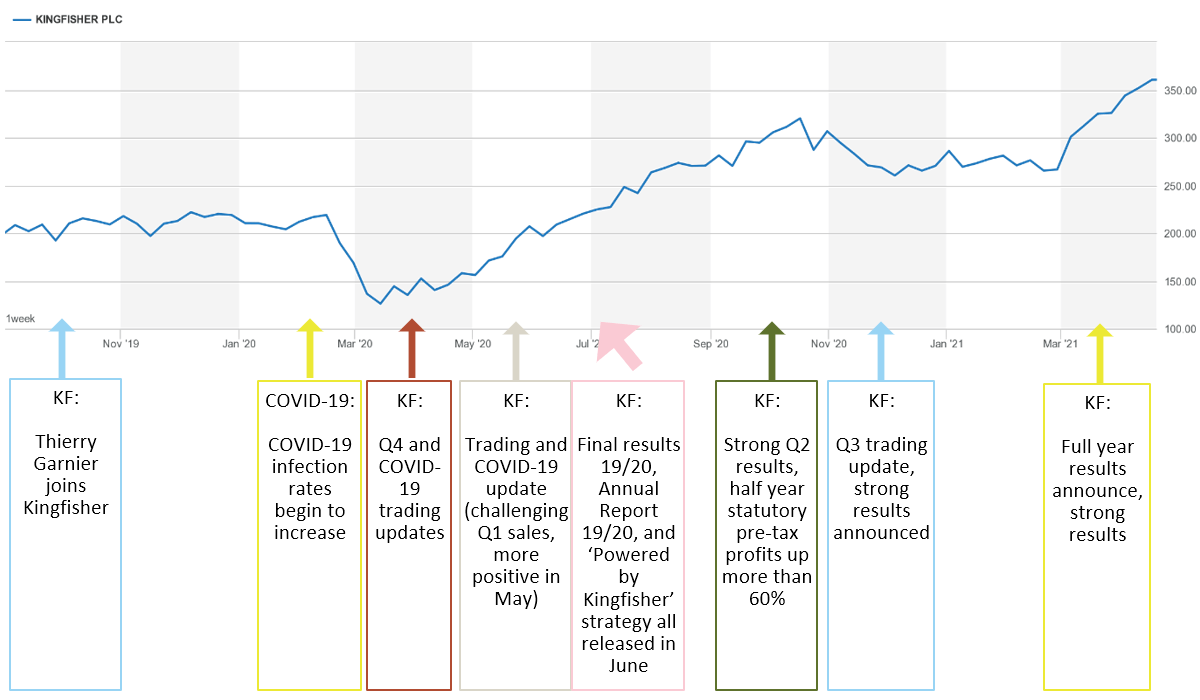

There are various factors that might influence a company’s share price, some of which are included in the following diagram. When thinking about their share price, companies will often spend time focussing on factors that are within their control, such as mitigating against external risks (e.g. their COVID-19 response) and developing strategies to drive long-term value (e.g. ‘Powered by Kingfisher’).

Kingfisher’s share price

You can follow Kingfisher’s share price on websites such as the investor section of kingfisher.com and the London Stock Exchange, where it is listed under the acronym KGF. UK PLC shares are ordinarily shown in GBP currency in pence, so, for example, a share price of 100.00 equals £1.00. At the time of writing, Kingfisher’s share price was 363.50, with a daily high of 367.20 and low of 361.30. This means that over the course of one day the range of prices for Kingfisher shares varied by 5.90 pence. Over the last 12 months, the share price reached a high of 372.20 and a low of 134.01. This reflects what has been a remarkable year due to various factors including the initial negative impact of the COVID-19 pandemic on the share price.

At Kingfisher there has been a notable increase in share price in the last year, outperforming the wider Financial Times Stock Exchange 100 Index (FTSE 100), of which we are a constituent. The FTSE 100 is an index of the 100 companies listed on the London Stock Exchange with the highest market capitalisation, that is, those with the highest value when all their shares are added together.

The chart below shows the share price of Kingfisher shares over the last 18 months, alongside some historic events which may provide some context to the share price changes. Remember: it is not practical to account for all the different factors that may have influenced share price and so these are indicative only. Whilst looking at trends is interesting and informative, historical performance may not be an indicator of future performance.

Your 1+1 Plan contributions will be used to buy your Purchased Shares in July 2021. The price paid will be whatever the share price is at the time: a lower share price will mean you’ll receive more shares each with a lower value, whilst a higher share price will mean you’ll receive fewer shares each with a higher value. Whilst the actual number of shares you receive will vary, their total value will always be equal to your contributions at the time of purchase. In addition, Kingfisher will also give you the same number of Matching Shares (or Mirror Matching Shares). If you choose to sell your shares after they are bought they will be sold based on the share price at the time of sale which might be more or less than you paid for them.

Results and reports

Each year, Kingfisher issue a number of results and reports including trading updates, half-year and full-year results, and the Annual Report and Accounts. When released, these documents are available to read on the investors section of the kingfisher.com website. They are often highly anticipated by shareholders, and therefore checking the Kingfisher share price for the time following their release can be particularly interesting. The most recent report was Kingfisher’s First Quarter Trading Update for the 2021/22 financial year, released on 20 May.