FAQ & Glossary

Sharesave provides the opportunity for you to save for 3 and/or 5 years, and then use your savings to buy Kingfisher shares at a discounted Option price. ShareSave is our name for a common type of share plan, called Save As You Earn (SAYE). SAYE is approved by His Majesty's Revenue and Customs (HMRC), and so has some tax advantages for colleagues paying UK tax (see 'At the end of ShareSave'). However, this also means there are some things about ShareSave that we can't control, such as the level of the bonus or interest.

ShareSave is designed to work around you. You can save from £5 a month, up to £250 a month into this year's ShareSave, providing your total savings don't exceed £500 per month across all open ShareSave accounts. You can take a break from saving, or leave ShareSave and take all your money back at any time. For more information on this, see 'During ShareSave'.

The number of shares you can buy at the end of ShareSave, if this is what you choose to do, depends on:

- How much you choose to save each month

- Our discounted Option price

Try out the calculator to see how many shares you could buy with your savings at the end of ShareSave. You can also watch your savings grow by logging in to your EquatePlus account.

Before the start of ShareSave each year, we fix the discounted Option price. This is the price of our shares on the market at the time, with a 20% discount.

This is the price you can choose to buy your shares for at the end of ShareSave — no matter what happens to our share price. It means if the value of Kingfisher shares increases by the end of ShareSave, you can still buy your shares at the discounted Option price set at the start of ShareSave. If our share price decreases over the time you save, you can choose whether to still buy shares at the discounted Option price, keep them and decide to sell them later, or take all your savings back.

If you complete the saving period (3 and/or 5 years), you get a tax-free bonus, set by HMRC. This is instead of getting interest on your savings. The tax-free bonus for ShareSave 2024 is:

- 1.1 times your monthly contribution if you're saving for 3 years

- 3.0 times your monthly contribution if you're saving for 5 years

If you leave ShareSave early, you won't get your tax-free bonus. However, if you've been in ShareSave at least one year, you'll get some interest. The interest rate for ShareSave 2024, set by HMRC, is 1.33%.

This is the rate for 2024, but it may change each year.

If you've joined ShareSave in a previous year, you can still join this year's ShareSave. There are a few things you need to consider:

- Your savings across all ShareSave accounts can't go over the maximum of £500 a month.

- If you have an existing ShareSave that is due to finish in December this year, and you've not missed any contributions, then the amount you save as part of that ShareSave doesn't count towards your maximum limit for the year. So any savings your put into the ShareSave finishing in December, you can use for the ShareSave that begins in October.

- If you want to increase your savings limits for this year, you can cancel an existing ShareSave — but you will lose the opportunity to buy the shares for the ShareSave you're cancelling.

- You can't transfer your savings from an existing ShareSave into a new one.

ShareSave is available to all our UK colleagues (including Channel Islands and Isle of Man). You can join if you:

- Work directly for a company in the Kingfisher group, including B&Q and Screwfix, and

- Have been with Kingfisher for at least three months at the date the invitation period opens, and

- Pay UK income tax.

If you haven't worked with us long enough to join this year, don't worry — ShareSave 2025 will soon come around!

ShareSave is open for a limited time each year, usually in October. We send out communications close to the time, to give everyone the opportunity to join if they want to. This year, you can join from 10am on Monday 30 September until 5pm Friday 18 October.

You can join via EquatePlus, our share plan platform. It's run by Computershare, our share plans administrator.

When ShareSave opens, we will arrange for the EquatePlus user ID to be sent to every eligible colleague.

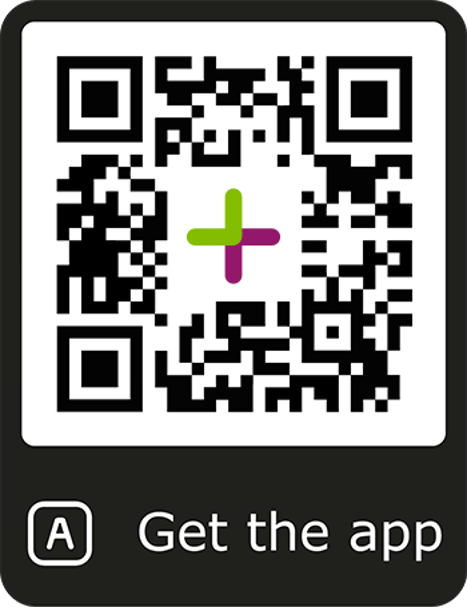

| Join from your desktop | Join through the mobile app | ||

|---|---|---|---|

|

|

Can't find your login details? Go to the EquatePlus login page to request your password, or call Computershare on 0808 234 3577 — they'll be happy to help you.

When you finish saving for ShareSave, you will get a tax-free bonus. This is instead of having interest on your savings. The level of the tax-free bonus is decided by HMRC, and so isn't under Kingfisher's control.

If you leave ShareSave early, you may get some interest instead of a tax-free bonus. To get this interest, you need to save for at least 12 months. The level of interest is again, decided by HMRC, and so isn't under Kingfisher's control. The interest rate for ShareSave 2024 is 1.33%.

Unfortunately not — once you've chosen your monthly amount, you'll need to stick to it until the end of ShareSave. However, you can take a savings break if you need to — see 'Can I take a savings break?'.

Unfortunately not — once you've chosen how long you want to save for, you'll need to stick to it. However, you can leave ShareSave — see 'Can I leave ShareSave early?'.

Yes, you can take a savings break of up to 12 months if you need to. This can be a single break of 12 months, or a series of shorter breaks. You'll need to tell payroll when you want to take a savings break, and how long for, as well as when you want to re-start saving.

If you decide to take a savings break, that time will be added to the end of ShareSave. For each month you take a savings break, you'll save for one month longer. This will delay the date at which you can buy your shares. You can't make up for missed payments by back-dating them or overpaying in future months.

If you take more than 12 months' break, your ShareSave contract will end, and you can take all your savings back. If you started ShareSave in 2023 or later, you'll also receive some interest on your savings if you've been in ShareSave for more than a year.

If you take a period of long-term leave (family leave, long-term sickness or a career/student break) and the amount you are paid is more than the amount you are saving each month, you will automatically continue to save.

If you're not receiving sufficient pay to cover the amount you are saving, you can either take a break, or arrange to make the payments yourself while you're away. If you want to continue saving, please contact Computershare on 0808 234 3577 to set up a standing order. You will also need to contact your payroll team so they can update your records.

You can still buy your shares at the discounted Option price if you:

- Complete all of your ShareSave payments while you're on leave, or

- Return to work after your leave, or

- Decide to leave, and it's been more than 3 years since you started ShareSave.

If you don't return to Kingfisher after your leave, you can cancel your ShareSave and get all your savings back.

Yes, you can leave ShareSave at any time and take all your savings back. If you've been saving for more than a year, you may get some interest on your savings, too. This will be paid to you by Computershare and not by your payroll.

You can request to leave ShareSave through the EquatePlus portal.

Please note if you choose to leave early, you won't be able to buy Kingfisher shares at the discounted share price.

Yes. Your savings are held independently by the Bank of Scotland, and are protected by the Financial Services Compensation Scheme. For more information, see the 'Legal Info' page.

No, joining ShareSave will not impact statutory sick pay, statutory maternity pay, or any other employee benefits you receive.

If you lose your user ID or forget your password, you can ask for your login details to be sent to your email address. Go to the EquatePlus login page, and follow the on-screen prompts.

For any other issues accessing your EquatePlus Portal, contact Computershare on 0808 234 3577.

If you change your name and/or address, please refer to the guidance provided by your HR team to let them know your new details. They will update your EquatePlus portal once payroll have updated their records.

When you finish saving into ShareSave, your tax-free bonus (for plans from 2023 onwards) will be added to your savings. You then have six months to make a choice. You can:

- Take all your savings back, including any applicable bonus, as cash, or

- Use your savings and any applicable bonus to buy Kingfisher shares at the discounted Option price set at the beginning of ShareSave.

If you take all your savings back, your Option to purchase the shares remains valid for the remainder of your six month exercise window. So, if you change your mind, you'll need to contact Computershare and arrange to return your savings to them, and they will update your account. You can then instruct them to purchase the shares at the original discounted Option price.

If you choose to buy Kingfisher shares at the discounted Option price, they're yours to do with as you wish. You may:

- Keep them and become a Kingfisher shareholder — receive dividends and vote at general meetings

- Sell them immediately and receive the proceeds

- Transfer your shares to an Individual Savings Account (ISA)

- Transfer your shares to your spouse or civil partner.

Remember, you'll need to make your choice within six months of finishing saving into ShareSave. You can do this on the EquatePlus portal.

What you choose to do may depend on a number of factors, including your personal circumstances and our share price at the time. These are the potential outcomes, and how they could impact you:

- Our share price increases while you're saving. If you buy your shares at the discounted Option price, you get a discount on your shares of 20% plus any increase in the share price. For example, Mohammed joins ShareSave when the Kingfisher share price is £2. With the 20% reduction, Mohammed knows he can use his savings to buy Kingfisher shares at the discounted Option price of £1.60. When ShareSave finishes the Kingfisher share price has gone up to £2.40. Mohammed can still buy his shares at £1.60, which is a discount of over 33%.

- Our share price decreases while you're saving by less than 20%. You still get a discount on your shares, but it'll be less than 20%. For example, Jane joins ShareSave when the Kingfisher share price is £1.50. With the 20% reduction, Jane knows she can use her savings to buy Kingfisher shares at the discounted Option price of £1.20. When ShareSave finishes, the Kingfisher share price has gone down to £1.30. Jane can still buy her shares at £1.20 — this is a discount of almost 8%.

- Our share price decreases while you're saving by more than 20%. You will pay more for the shares than they are worth. For example, Dean joins ShareSave when the Kingfisher share price is £2.50. With the 20% reduction, Dean knows he can use his savings to buy Kingfisher shares at the discounted Option price of £2.00. When ShareSave finishes, the Kingfisher share price has gone down to £1.50. Dean can still buy his shares at £2.00 — but he would make a loss of 25%. Dean can wait and see if the share price increases during his six month exercise window however, he decides instead to take all of his savings and his bonus back as cash.

However, Dean can still keep an eye on the share price and if it increases above the discounted Option price he can return all his savings and his bonus to Computershare, and buy the Kingfisher shares at the discounted Option price of £2.00. This all needs to be completed before the end of the six month exercise window, at which time the Option to take up the shares will lapse.

Remember, the share prices can go down as well as up, and will continue to fluctuate if you decide to keep your shares.

Any profits you make when you sell your shares may be subject to Capital Gains Tax — see the tax questions below for more information.

Whether you need to pay any tax at the end of ShareSave — and how much you need to pay — will depend on your personal circumstances, and what you choose to do.

- Taking back your savings. There's no tax to pay on your savings at this point; and your bonus is tax-free!

- Buying shares and selling them. You won't need to pay any Income Tax. However, if you sell your shares for more than you paid for them, you'll make a profit. You may have to pay Capital Gains Tax (CGT) on your profit, although not on costs such as bank transfer fees. HMRC provides a tax-free allowance every year. This means you can keep the first bit of profit you make tax-free. This applies to any profit from all assets you sell in a tax year, including shares in other companies. The allowance is currently £3,000 per tax year. Future CGT allowance rates are subject to change, see the HMRC website for more details.

- Keeping your shares. You're entitled to dividends from Kingfisher. This is a share of our profits, which we pay to our shareholders typically twice a year, although this is not guaranteed. Each year, HMRC gives you a dividend allowance before you have to pay tax on dividends. This allowance is across all the shares you own, including shares in other companies. The allowance is currently £500, for more details, see the HMRC website.

- Buying shares and transferring them to an ISA. You can transfer your shares to a stocks and shares ISA. If you do this within 90 days, you won't have to pay any CGT. You also won't have to pay tax on any dividends you may receive while you keep your shares, and even better, you won't have to pay CGT on any sale directly from your ISA.

If you need to pay CGT or Dividend tax, you'll need to report it to HMRC. You can do this by filling out a self-assessment tax return. If you need to pay CGT, you can also use HMRC's real-time CGT service. The amount of tax you need to pay will depend on your personal circumstances.

If you're not sure whether you need to pay tax, you can speak to a professional financial adviser, or fill out a self-assessment tax return — HMRC will then let you know if you need to pay any tax.

If you leave Kingfisher before the end of the savings period, you'll get your savings back in full — although you won't get your tax-free bonus. If you leave 12 months or more after you join ShareSave, you may receive interest on your savings (see 'What is the bonus?').

You generally won't have the opportunity to buy the shares at the discounted Option price. There are some exceptions to this — you can still use your savings to buy your discounted shares if you leave because of:

- Injury

- Disability

- Redundancy

- Retirement

- Your employer leaves the Kingfisher Group

If you leave for one of these reasons at any time — or for any reason (except misconduct) and you've been in ShareSave for more than 3 years — you can continue to save for up to 6 months after you leave Kingfisher. In those 6 months, you can buy your shares at the discounted Option price; or choose to take all of your money back. If you don't make a decision within those 6 months, you'll only be able to get back all your savings. If you've saved for more than a year, you may also get some interest on your savings.

Please see our Leavers page for more information.

It's not something we want to think about, but if you die while you're saving in ShareSave, your contributions will automatically stop. Your personal representative can choose to:

- Take back your savings in full

- Use your savings to buy the discounted shares with the savings held at that time. They'll need to do this within 12 months of the date of death, or the end of ShareSave — whichever comes first.

For more guidance on this, please contact Computershare on 0808 234 3577.

At Kingfisher, we are committed to support each colleague to ensure that you do not misuse, or place yourself under suspicion of misusing, information about the Group which you have, and which is not public.

If you do have special access to information, you are known as a restricted employee. This means you can't make investment decisions based on what you know. If you're a restricted employee, the Group Company Secretariat will let you know. If you're in any doubt, you can contact them by emailing secretariat@kingfisher.com.

ShareSave is open to all eligible colleagues in the UK, Channel Islands and the Isle of Man. If you are a restricted employee, you may need to seek clearance in certain circumstances.

As a restricted employee, you DO NOT need to seek clearance if you want to…

- Join ShareSave

As a restricted employee, you DO need to seek clearance if you want to…

- Leave ShareSave and withdraw your savings

- Buy shares at the discounted Option price at the end of ShareSave

- Sell your ShareSave shares after you've bought them

- Transfer your ShareSave shares after you've bought them (including to your spouse or partner).

You can request Clearance to Deal at kingfisherportal.com. You will need to use your work asset, such as your laptop.

You can access our Group Share Dealing Policy on the Kingfisher Intranet. By submitting a request on EquatePlus, you confirm that you have complied with the Group Share Dealing Policy.

We try to not use industry jargon in our communications, but if you happen to see any of the following terms then here are simple explanations of each.

- Savings amount

-

This is the amount you choose to save each month — between £5 and £250.

- Savings period

-

This is the amount of time you save for — 3 and/or 5 years.

- Share Option

-

Share Option refers to the fact you have a right to purchase a set number of Kingfisher shares at a fixed discounted price once all monthly savings are complete. A share Option is exactly what it says, it's an Option, so it's entirely up to you to choose whether you wish to use your savings to buy the Kingfisher shares or take your savings back.

- Option price

-

Option price refers to the fixed share price set for each annual ShareSave invitation. This is based on the market value just before the invitation period starts, which is then discounted by 20%.

- Invitation period

-

Invitation period is the period of time each year where eligible employees have the chance to join the ShareSave. This is a window of 14 to 21 days and is usually in October each year. You have to apply to join during this time, or you'll miss out until the following year.

- Grant Date

-

Grant date is the formal start date of your ShareSave 3 and/or 5 year savings period, which takes place once the invitation period closes and the Kingfisher Share Plans Team has reviewed all applications and confirmed them.

- Maturity Date

-

Maturity date is the date when your savings period comes to an end and all payments have been made, and your Share Option becomes available to you.

- Exercise / Exercise window

-

Exercise means the action of taking up your Option and buying the shares. The Exercise window is the period of 6 months you have to make a decision about your ShareSave savings before your Option expires — to choose to either buy Kingfisher shares at the discounted Option price or take back your savings.