ShareSave empowers you to share in our future and save for yours too.

It's an easy way to save and buy Kingfisher shares at a discounted price.

And for ShareSave 2024, you'll also get a bonus when you finish saving!

Watch our video to discover how ShareSave could work for you…

Here's how it works

Join…

and choose how much to save — from £5 up to £250 each month directly from your salary.

Save…

for 3 and/or 5 years. Watch your savings grow each month. Take a break of up to 12 months if you need to.

Receive…

a bonus when you finish saving.

Choose…

to buy Kingfisher shares at a discounted price

Or

Take all your savings back.

Important: tax information

Colleagues who join ShareSave will need to pay income tax and social security contributions on the value of the ShareSave discount. This is the amount between the fixed discounted Option price of the shares they can buy at the end of ShareSave, and the market value of the Options when they are formally given to them on the grant date. You may need to pay this tax at the start of ShareSave and it may be taken from your pay in November 2024. Find out more on the FAQs page.

Key benefits

Get back what you put in… or more

- Take all your savings back at any time.

- Save for at least 12 months, and you'll get interest on your savings.

- Save for the full 3 and/or 5 years, and you'll get a bonus added to your pot!

- When you finish saving, use your pot to buy shares at the discounted Option price — or take all your savings back in cash.

ShareSave works around you

ShareSave is flexible. You can take a savings break of up to 12 months if you need to, or choose to take your all your savings back at any time.

Your shares are discounted

If you choose to buy shares with your savings, you won't pay the market price for them. Instead, you'll get them at the discounted Option price, which is set before you start saving. This is a 20% discount on the market price of Kingfisher shares at the start of ShareSave — so you can benefit from any potential increase in our share price, too!

Own a share in any future sucess

Owning shares in Kingfisher means owning a part in our future success. If our share price increases over time, the value of your shares will, too! But remember that share prices can fall as well as rise.

Enjoy the perks of being a shareholder

As soon as you buy a Kingfisher share, you're a Kingfisher shareholder — and this means enjoying some great benefits!

- If you keep your shares, you'll get a share of our profits — known as dividends — whenever we pay these to our shareholders.

- You can also have your say on important company matters, such as company policy and key decisions as to how it's governed, by voting at our General Meetings.

Watch our video for more about the benefits of being a Kingfisher shareholder.

Remember

You can sell your shares at any time. If you sell them for more than you paid for them, you'll make a profit!

Your handy timeline

Make your savings work for you

Taking back your savings

Here's how your money could build up…

| After 3 years you have… | After 5 years you have… | |||||

|---|---|---|---|---|---|---|

| You save | Saved | Bonus (1.1) | Total | Saved | Bonus (3.0) | Total |

| £20 | £720 | £22 | £742 | £1,200 | £60 | £1,260 |

| £50 | £1,800 | £55 | £1,855 | £3,000 | £150 | £3,150 |

| £100 | £3,600 | £110 | £3,710 | £6,000 | £300 | £6,300 |

| £250 | £9,000 | £275 | £9,275 | £15,000 | £750 | £15,750 |

These are the bonus rates for the 2024 ShareSave. Previous and future invitations to join ShareSave may have different bonus rates.

Using your savings to buy shares

Give our calculator a try to help you model what using your savings pot to purchase shares might look like.

Additional resources

Making the right decision for you

ShareSave empowers you to share in our future and save for yours too. We'd love you to join, but only if you feel it's right for you.

To help you decide, here are some key questions you might want to chat through with family and friends:

- Am I fully aware of the tax consequences of participating in ShareSave?

- What will I want to use my savings for?

- Can I afford to put aside the amount I choose to save each month?

- Are my circumstances likely to change?

- If I choose to buy the shares and their value drops, how will I feel?

Joining ShareSave is your decision — and yours alone.

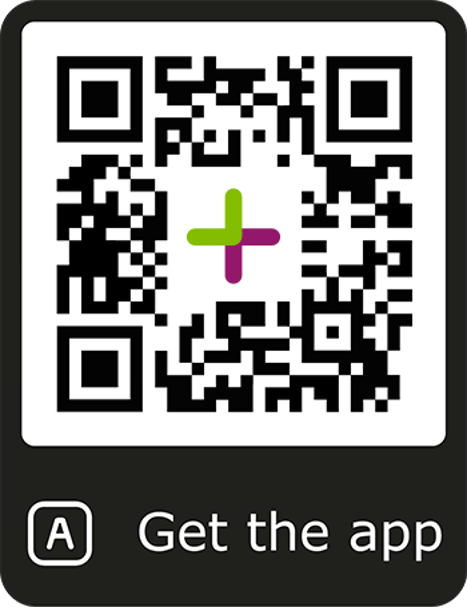

Manage your ShareSave on the EquatePlus portal

EquatePlus is our share plan platform run by Computershare, our share plan administrator.

This is where you go to:

- Watch your savings pot grow

- Choose what to do with your savings when ShareSave ends

- Keep your contact details up to date

- Tell us you want to leave ShareSave

Watch out for future updates to join when ShareSave opens again in 2025.

If you are logged into

the Kingfisher network

Make sure you're connect to the Kingfisher network.

If you are not on

the Kingfisher network

You'll need your USER ID and PASSWORD.

Follow on-screen help if you have forgotten these.

Support

Thinking of joining but still have a few questions? Get in touch with the share plan team:

shareplan.enquiries@kingfisher.comNeed help with EquatePlus? Computershare, our share plans administrator, will be happy to help.

Call them on our dedicated helpline (Sunday 10pm – Friday 10pm CET):

0808 234 3577